The SIPC-7 General Assessment Form is to be filed by all members of the Securities Investor Protection Corporation (“SIPC”) for the member’s entire fiscal year, due no later than sixty (60) calendar days after the end of the fiscal year or after membership termination. All payments are due by midnight eastern time. Every day is counted, including intermediate Saturdays, Sundays, and federal holidays, and includes the last day of the period. If the last day is a Saturday, Sunday, or federal holiday, the due date is extended until the end of the next day that is not a Saturday, Sunday, or federal holiday.

Amounts reported on the SIPC-7 General Assessment Form must be readily reconcilable with the member’s records and the Securities and Exchange Commission Report 17a-5 filed. Questions pertaining to this form should be directed to SIPC’s Membership Department via Portal Message or by telephone, 202-371-8300.

For the purposes of this form, the term “SIPC Net Operating Revenues” shall mean gross revenues from the securities business as defined in or pursuant to section 78ll(9)l of the Securities Investor Protection Act of 1970 ("SIPA") and Article 6 of SIPC’s Bylaws, less item 5.

Gross revenues of subsidiaries, except foreign subsidiaries, are required to be included in SIPC Net Operating Revenues on a consolidated basis except for a subsidiary filing separately. If a subsidiary was required to file a Rule 17a-5 annual audited statement of income separately and is also a SIPC member, then such subsidiary must itself file a SIPC-6 General Assessment form, pay the assessment due, and should not be consolidated in another member’s SIPC-6.

Line by Line Instructions

Your SIPC-7 General Assessment should be completed as follows:

Line 1 (Total Revenue):

- For the fiscal year enter the total revenue number reported in the Annual Audited Statement of Income submitted in accordance with SEC Rule 17a-5(d), 17 C.F.R. § 240.17a-5(d). If exempted from that rule, enter the total revenue number from the FOCUS Report (X-17A-5) – Statement of Income (Loss) – Code 4030. If the total revenue number from your Audited Statement of Income does not match the total revenue number from the FOCUS Report, please submit an explanation explaining the difference.

The purpose of the Additions (lines 2a-2g) and Deductions (lines 4a-4h) is to determine SIPC Net Operating Revenues.

Lines 2a-2g. Additions:

- Lines 2a through 2g assure that assessable income and gain items of SIPC Net Operating Revenues are totaled, unreduced by any losses (e.g., if a net loss was incurred for the period from all transactions in trading account securities, that net loss does not reduce other assessable revenues).

- Line 2a. Include the SIPC Net Operating Revenues for any predecessor member which are not included in Line 1 (Total Revenue) and were not reported separately and the SIPC assessments which were not paid by such predecessor.

- Line 2b. The term “securities in trading accounts” is defined by SIPC Bylaw and means “securities held for sale in the ordinary course of business and not identified as having been held for investment.”

- Line 2d. Include all short dividend and interest payments including those incurred in reverse conversion accounts, rebates on stock loan positions and repo interest which have been netted in determining Line 1.

- Line 2g. The term “securities in investment accounts” is defined by SIPC bylaw and means “securities that are clearly identified as having been acquired for investment in accordance with provisions of the Internal Revenue Code applicable to dealers in securities.”

Line 2h. Total Additions:

- Line 2h will automatically populate with the sum of Lines 2a through 2g.

Line 3.

- Line 3 will automatically populate with the sum of Line 1 and Line 2h.

Lines 4a-4h. 5a-5c. Deductions:

- Lines 4a through 5c are deductions that are provided for in SIPA (as is the deduction 4a) or are otherwise allowed to arrive at an assessment base consisting of net operating revenues from the securities business.

- Line 4e. The term “securities in investment accounts” is defined by SIPC Bylaw and means “securities that are clearly identified as having been acquired for investment in accordance with provisions of the Internal Revenue Code applicable to dealers in securities.”

-

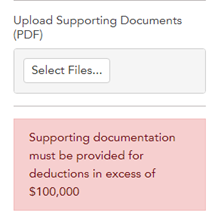

Line 4h. If the amount reported on line 4h aggregates to $100,000 or greater, supporting documentation must be uploaded, using the Select Files button.

You will not be able to submit your form without uploading supporting documentation.

Examples of acceptable supporting documents include contractual agreements, prospectuses, limited partnership documentation, and receipts. - Line 5c. Allows for a deduction of either the total interest and dividend expense (not to exceed interest and dividend income) as reported on FOCUS Report – Statement of Income (Loss) – code 4075, plus Line 2d or 40% of interest earned on customers’ securities accounts (40% of FOCUS Report – Statement of Income (Loss) – Code 3960 (Part II filers) or 40% of margin interest revenue (Part IIA filers)).). Be certain to complete both lines 5a and 5b. Dividends paid to shareholders are not considered “Expense” and thus are not to be included in the deduction. Likewise, interest and dividends paid to partners pursuant to partnership agreements would also not be deducted. The greater of line 5a or 5b will automatically populate line 5c.

Line 6. Total Deductions.

- Line 6 will automatically populate with the sum of Lines 4a through 4h and Line 5c.

Line 7. SIPC Net Operating Revenues.

- Line 7 will automatically populate with the value of Line 3 (Total Revenue plus Total Additions) minus Line 6 (Total Deductions).

Line 8. General Assessment.

- Line 8 will automatically populate with the General Assessment due, calculated by multiplying Line 7 (SIPC Net Operating Revenues) by the assessment rate (currently 0.0015 of Net Operating Revenues).

Line 9. Current overpayment/credit balance, if any.

- Line 9 will automatically populate with the amount of the member’s available credit. If the member does not have a credit balance, the line will be blank.

Line 10. General Assessment from last filed SIPC-6 or 6A.

- Line 10 will automatically populate with Line 8 (General Assessment) from your previously filed SIPC-6 for the same fiscal year. If you previously filed one or more SIPC-6As, it will populate with Line 8 from the most recently filed SIPC-6A.

Line 11a. Overpayment(s) applied on SIPC-6 and SIPC 6As.

- Line 11a will automatically populate with the amount of overpayment applied on your SIPC-6 (Line 9) up to the amount of the General Assessment due (Line 8). If you filed a SIPC-6A, Line 11a will populate with the sum of Line 9 from the SIPC-6 and all SIPC-6As filed up to the amount of the General Assessment due (Line 8) on the most recently filed SIPC-6A. In situations where the overpayment/credit balance (Line 9) is larger than the General Assessment (Line 8) on the prior SIPC-6 or SIPC-6A, Line 11a will populate only up to the amount of the General Assessment (Line 8) on the most recently filed SIPC-6 or SIPC-6A.

Line 11b. Any other overpayments applied.

- If amending a prior year’s assessment form created an overpayment/credit balance which was automatically applied to an outstanding balance for the SIPC-6 for the first half of the fiscal period covered by this SIPC-7, Line 11b will automatically populate with the amount applied to the outstanding balance. This is a relatively rare situation. Line 11b for will be $0.00 for most filers.

Line 11c. All payments applied for SIPC-6 and SIPC-6a.

- Line 11c will automatically populate with the sum of all payments applied to balances from your SIPC-6 and SIPC-6As, if applicable. Please note this field will only equal the amount of payment applied which may not equal the amount of payment received by SIPC. Line 11c cannot be greater than Line 8 (General Assessment) from the previously filed form. The sum of Line 9 (Current overpayment/credit balance), if any, and 11c should equal the amount of payment received by SIPC from the member for this form and filing period. Please note that 11c will only contain cleared payments. A pending payment will not populate this field. If a payment made is missing from the SIPC-7, do not file the amended form and contact SIPC’s Membership Department via Portal Message or by telephone at 202-371-8300.

Line 11d.

- Line 11d will automatically populate with the sum of 11a (overpayments applied on SIPC-6 or 6A), 11b (any other overpayments applied) and 11c (all payments applied on SIPC-6 or 6A).

Line 12.

- Line 12 will automatically populate with the lesser of line 10 (general assessment from previously filed SIPC-6 or SIPC-6A) or Line 11d (sum of all overpayments and payments applied to the SIPC-6).

Line 13a.

- Line 13a automatically populates with the General Assessment (Line 8).

Line 13b.

- Line 13b automatically populates with the current overpayment/credit balance (Line 9).

Line 13c.

- Line 13c automatically populates with Line 12.

Line 13d. Assessment Balance Due.

- Line 13d automatically populates with the assessment balance due by subtracting the current overpayment balance (Line 9/13b) and all overpayments and payments applied on previous forms for this period (Line 12/13c) from the General Assessment (Line 8/13a). If the overpayment/credit balance (Line 9/13b) is greater than the General Assessment (Line 8/13a), this line (Line 13d) will automatically populate with the remaining overpayment/credit amount.

Line 14. Interest

- Line 14 will automatically populate the amount of interest due generally based on the number of days late at the time of form submission. Additional interest may be due if payment is not made on the same day the form is submitted . Line 14 will show $0.00 if the form is submitted before the due date.

Line 15. Amount you owe SIPC

- Line 15 automatically populates with the total assessment balance due (Line 13d) plus interest on late payment due (Line 14). This line only reflects the amount due to SIPC for this form’s filing period. You may owe SIPC assessment and interest from other assessment forms and filing periods and should verify the Balance Due on the Assessments & Payments page within the SIPC Broker-Dealer Portal.

Line 16. Overpayment/credit carried forward

If Line 9 (Current overpayment/credit balance) is larger than Line 13d (Assessment Balance Due) the remaining overpayment/credit will automatically populate on Line 16. This credit will be applied to future assessments.

Subsidiaries and Predecessors.

Complete this section only if subsidiaries and/or predecessors are included on this form. Gross revenues of subsidiaries, except foreign subsidiaries, are required to be included in SIPC Net Operating Revenues on a consolidated basis except for a subsidiary filing separately, as explained above. See SIPA § 78ddd(i).

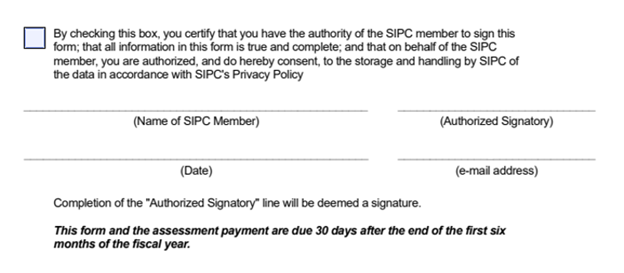

Signature Check Box.

You must check the signature check box prior to submitting the form. By checking this box, you certify that you have the authority of the SIPC member to sign the form, that all information in the form is true and complete and that on behalf of the SIPC member, you are authorized and consent to the storage and handling by SIPC of the data in accordance with SIPC’s Privacy Policy. The name of the SIPC Member, Date, Authorized Signatory and E-mail Address Lines will automatically populate.

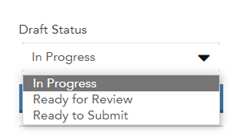

Save Draft.

If you are not ready to submit your form, you have the option to save a draft by clicking the blue “Save Draft” button. You can label the saved draft as “In Progress,” “Ready for Review,” or “Ready to Submit.” If you navigate to another page in the Portal without first saving a draft, all data will be lost.

Submit Form.

Click the blue Submit Form button.