The SIPC-7A Amended General Assessment Form is only filed by members of SIPC to correct a previously filed SIPC-7 General Assessment Form. The SIPC-7A must be received no later than three years after the SIPC-7 due date. Multiple SIPC-7As may be filed for the same fiscal period. However, if subject to the Agreed-upon Procedures (AUP) Report requirement, an AUP Report must be reissued to cover the amended filing. Questions pertaining to this form SIPC-7A should be directed to SIPC’s Membership Department via Portal Message or by telephone, 202-371-8300.

Line by Line Instructions

Lines 1-9.

These lines are the same as the SIPC-7 assessment form. (See SIPC-7 Instructions)

Line 10. General assessment from last filed SIPC-7 or 7A.

- Line 10 will automatically populate with Line 8 (General Assessment) from your previously filed SIPC-7 for the same fiscal year. If you previously filed one or more SIPC-7As, it will populate with Line 8 from the most recently filed SIPC-7A.

Line 11a. Overpayment(s) applied on SIPC-6 and SIPC 6As.

- Line 11a will automatically populate with the amount of overpayment applied on your SIPC-6 (Line 9) up to the amount of the General Assessment due (Line 8). If you have previously filed a SIPC-6A, it will populate with the sum of Line 9 from the SIPC-6 and all SIPC-6As filed up to the amount of the General Assessment due (Line 8). In situations where the overpayment/credit balance (Line 9) is larger than the General Assessment (Line 8) on the prior SIPC-6 or SIPC-6A, Line 11a will populate only up to the amount of the General Assessment (Line 8) on the most recently filed SIPC-6 or SIPC-6A.

Line 11b. Overpayment(s) applied on SIPC-7 and SIPC 7As.

- Line 11b will automatically populate with the amount of overpayment applied on your SIPC-7 (Line 9) up to the amount of the General Assessment due (Line 8). If you have previously filed a SIPC-7A, it will populate with the sum of Line 9 from the SIPC-7 and all SIPC-7As filed up to the amount of the General Assessment due (Line 8). In situations where the overpayment/credit balance (Line 9) is larger than the General Assessment (Line 8) on the prior SIPC-7 or SIPC-7A, Line 11b will populate only up to the amount of the General Assessment (Line 8) on the most recently filed SIPC-7 or SIPC-7A.

Line 11c. Any other overpayments applied.

- If amending a prior year’s assessment form created an overpayment/credit balance which was automatically applied to an outstanding balance for the fiscal period covered by this SIPC-7A, Line 11c will automatically populate with the amount applied to the outstanding balance. This is a relatively rare situation. Line 11c for will be $0.00 for most filers.

Line 11d. All payments applied for SIPC-6 and SIPC-6A.

- Line 11d will automatically populate with the sum of all payments applied to balances from your SIPC-6 and SIPC-6As, if applicable. Please note this field will only equal the amount of payment applied which may not equal the amount of payment received by SIPC. Line 11c cannot be greater than Line 8 (General Assessment) from the previously filed form. The sum of Line 9 (Current overpayment/credit balance), if any, and 11d should equal the amount of payment received by SIPC from the member for this form and filing period. Please note that 11c will only contain cleared payments. A pending payment will not populate this field. If a payment made is missing from line 11d of the SIPC-7A, do not file the amended form. Instead, contact SIPC’s Membership Department via Portal Message or by telephone at 202-371-8300.

Line 11e. All payments applied for SIPC-7 and SIPC-7As.

- Line 11e will automatically populate with the sum of all payments applied to balances from your SIPC-7 and SIPC-7As, if applicable. Please note this field will only equal the amount of payment applied which may not equal the amount of payment received by SIPC. Line 11e cannot be greater than Line 8 (General Assessment) from the previously filed form. The sum of Line 9 (Current overpayment/credit balance), if any, and 11d should equal the amount of payment received by SIPC from the member for this form and filing period. Please note that 11e will only contain cleared payments. A pending payment will not populate this field. If a payment made is missing from line 11e of the SIPC-7A, do not file the amended form. Instead, contact SIPC’s Membership Department via Portal Message or by telephone at 202-371-8300.

Line 11f.

- Line 11f will automatically populate with the sum of 11a (overpayments applied on SIPC-6 or 6A), 11b (overpayments applied on SIPC-7 or 7A), 11c (any other overpayments applied), 11d (all payments applied on SIPC-6 or 6A) and 11e (all payments applied on SIPC-7 or 7A).

Line 12.

- Line 12 will automatically populate with the lesser of line 10 (general assessment from previously filed SIPC-7 or SIPC-7A) or Line 11f (sum of all overpayments and payments applied to the SIPC-7).

Line 13a.

Line 13a automatically populates with the General Assessment (Line 8).

Line 13b.

Line 13b automatically populates with the current overpayment/credit balance (Line 9).

Line 13c.

Line 13c automatically populates with Line 12.

Line 13d. Assessment Balance Due.

- Line 13d automatically populates with the assessment balance due by subtracting the current overpayment balance (Line 9/13b) and all overpayments and payments applied on previous forms for this period (Line 12/13c) from the General Assessment (Line 8/13a). If the overpayment/credit balance (Line 9/13b) is greater than the General Assessment (Line 8/13a), this line (Line 13d) will automatically populate with the remaining overpayment/credit amount.

Line 14. Interest

- Line 14 will automatically populate the amount of interest due generally based on the number of days late at the time of form submission. Additional interest may be due if payment is not made on the same day the form is submitted. Line 14 will show $0.00 if the form is submitted before the due date.

Line 15. Amount you owe SIPC

- Line 15 automatically populates with the total assessment balance due (Line 13d) plus interest on late payment due (Line 14). This line only reflects the amount due to SIPC for this form’s filing period. You may owe SIPC assessment and interest from other assessment forms and filing periods and should verify the Balance Due on the Assessments & Payments page within the SIPC Broker-Dealer Portal.

Line 16. Overpayment/credit carried forward

- If Line 9 (Current overpayment/credit balance) is larger than Line 13d (Assessment Balance Due) the remaining overpayment/credit will automatically populate on Line 16. This credit will be applied to future assessments.

Subsidiaries and Predecessors.

Complete this section only if subsidiaries and/or predecessors are included on this form. Gross revenues of subsidiaries, except foreign subsidiaries, are required to be included in SIPC Net Operating Revenues on a consolidated basis except for a subsidiary filing separately, as explained above. See SIPA § 78ddd(i).

Signature Check Box.

You must check the signature check box prior to submitting the form. By checking this box, you certify that you have the authority of the SIPC member to sign the form, that all information in the form is true and complete and that on behalf of the SIPC member, you are authorized and consent to the storage and handling by SIPC of the data in accordance with SIPC’s Privacy Policy. The name of the SIPC Member, Date, Authorized Signatory and E-mail Address Lines will automatically populate.

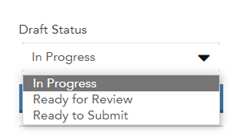

Save Draft.

If you are not ready to submit your form, you have the option to save a draft by clicking the blue “Save Draft” button. You can label the saved draft as “In Progress,” “Ready for Review,” or “Ready to Submit.” If you navigate to another page in the Portal without first saving a draft, all data will be lost.

Submit Form.

Click the blue Submit Form button.